Introduction

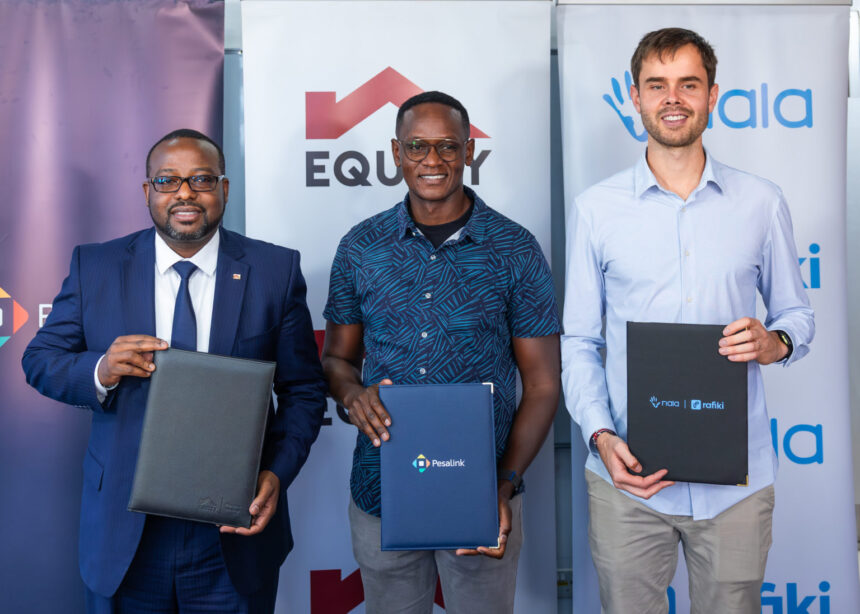

NALA Kenya remittance solution is transforming the cross-border payments landscape for Kenyans. Through its strategic partnership with Equity Bank and PesaLink, the Tanzanian fintech now enables diaspora remitters to send money that arrives instantly, securely, and at a much lower cost. This article explores how the partnership overcomes regulatory hurdles, delivers real-time transfers, and positions NALA for success in East Africa’s most competitive financial market.

How NALA Kenya Remittance Solution Works

NALA Kenya remittance solution leverages PesaLink’s instant payment infrastructure and Equity Bank’s wide local network. Senders across the United States, the United Kingdom, and Europe can use the NALA app to initiate transfers. Funds clear instantly through PesaLink and are deposited directly into recipients’ bank accounts or mobile wallets. This arrangement helps NALA bypass lengthy licensing processes, allowing rapid entry into Kenya’s fast-growing remittance market.

Why This Matters for Kenya

Kenya’s remittance inflows grew by nearly 18 percent in 2024, reaching a record of 4.94 billion US dollars. These inflows are now the country’s second-largest source of foreign currency after agricultural exports. By offering affordable and instant transfers, NALA Kenya remittance solution addresses a crucial demand for households and small businesses that depend heavily on money sent from abroad.

Streamlined Market Entry Through Partnerships

One of the biggest challenges for new financial service providers in Kenya is obtaining regulatory approvals. NALA Kenya remittance solution avoids this delay by working directly with Equity Bank and PesaLink, the national interbank switch operated under the Kenya Bankers Association. This strategic partnership ensures compliance while giving NALA immediate access to the Kenyan market.

Alignment with Equity Bank’s Growth Vision

Equity Bank has highlighted how this collaboration aligns with its broader Africa Recovery and Resilience Plan. The plan focuses on creating inclusive financial growth across the continent. The NALA Kenya remittance solution is not only a technical integration but also a shared effort to boost economic empowerment and financial accessibility.

Leveraging Infrastructure and Expertise

PesaLink is known for providing secure and instant cross-bank transfers, while Equity Bank contributes its wide reach across Kenya. NALA brings global fintech expertise and user-friendly technology. Together, the three organizations are creating a smooth, efficient, and reliable remittance experience. Industry leaders note that this collaboration reduces friction for senders and receivers, making transactions more seamless than ever before.

Tackling High Costs in Cross-Border Transfers

The global remittance industry has long been criticized for excessive fees. Billions are lost annually to high charges and unfavorable exchange rates. NALA Kenya remittance solution seeks to change this by lowering transaction costs and ensuring customers benefit directly from the savings. This affordability is one of the fintech’s strongest competitive advantages.

Competing in a Crowded Market

Kenya’s payment ecosystem is highly competitive, with dominant players such as M-PESA, Western Union, and MoneyGram, along with banks that have established diaspora banking services. For NALA to thrive, it must prove its reliability, maintain lower fees, and sustain fast delivery times. The partnership with Equity Bank and PesaLink provides a strong foundation to compete effectively in this crowded space.

Why the Timing Is Right

The launch of NALA Kenya remittance solution comes at a crucial time. As the country’s remittance inflows grow steadily, so does the need for faster, cheaper, and more transparent services. Traditional channels often take days to process payments or charge high fees. NALA’s entry offers Kenyans an alternative that combines affordability, speed, and security.

The Road Ahead

If NALA can maintain its promise of low-cost, instant, and reliable transfers, it could emerge as a preferred choice for diaspora remittances. The Equity Bank and PesaLink partnership provides strong credibility and scalability. This move represents one of NALA’s most ambitious expansions in East Africa and may redefine how Kenyans receive money from abroad.

Key Highlights of NALA Kenya Remittance Solution

| Aspect | Benefits Offered |

|---|---|

| Speed | Instant transfers to bank accounts or mobile wallets |

| Cost Efficiency | Lower fees than traditional remittance channels |

| Regulatory Advantage | Market entry simplified through partnerships |

| Trust & Reach | Backed by Equity Bank’s network and PesaLink’s infrastructure |

| Market Potential | Taps into a 4.94 billion-dollar remittance market |

Conclusion

The NALA Kenya remittance solution marks a new chapter in the financial services industry. By combining speed, affordability, and trusted partnerships, it is positioned to challenge existing players and capture a significant share of Kenya’s diaspora remittance market. For millions of Kenyans who depend on funds from abroad, this innovation brings both relief and opportunity.