Meta’s Q2 2025 earnings have surpassed Wall Street expectations, revealing substantial growth in revenue, user engagement, and advertising performance. The tech giant reported a 22% year-over-year (YoY) revenue increase, hitting $47.52 billion, with net income of $18.34 billion—a 39% increase from the same quarter last year. Earnings per share (EPS) reached $7.14, outperforming market forecasts.

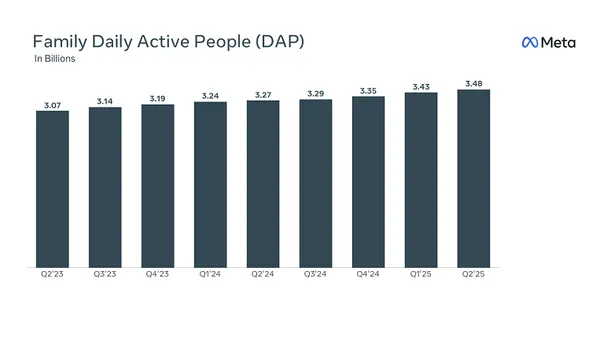

Fueled by its AI-powered advertising systems, Meta’s advertising revenue climbed 21% to $46.56 billion, contributing over 97% of total revenue. Platforms like Facebook, Instagram, WhatsApp, and Threads saw daily active users (DAUs) rise by 6%, reaching 3.48 billion globally.

Meta’s AI Strategy Delivers Real ROI for Advertisers

A major contributor to Meta’s revenue surge is its evolving AI infrastructure, which enhances ad delivery, creative optimization, and user targeting. Meta disclosed that AI-driven campaigns resulted in better engagement, with significant improvements in conversion rates on both Facebook and Instagram.

Over 2 million advertisers leveraged Meta’s AI tools, including automated video creation and performance prediction systems. These tools helped businesses scale with improved ad relevance and reduced manual input. CEO Mark Zuckerberg emphasized that Meta’s AI systems are now delivering “material business results” for advertisers across industries.

Investments in Reality Labs and Superintelligence R&D Continue

Despite strong ad revenue, Meta continues to heavily invest in long-term innovation through its Reality Labs division. The segment, which covers Meta’s VR/AR and AI Superintelligence ambitions, posted operating losses but remains central to the company’s future.

Capital expenditures for Q2 reached $17.01 billion, reflecting Meta’s push to build AI supercomputing infrastructure and enhance metaverse-related capabilities. For the full year, Meta forecasts total capital spending between $66 billion and $72 billion, with a focus on AI infrastructure expansion and next-generation immersive experiences.

Key Financial Highlights from Q2 2025

- Total Revenue: $47.52 billion (+22% YoY)

- Advertising Revenue: $46.56 billion (+21% YoY)

- Net Income: $18.34 billion

- Operating Margin: 43%

- EPS: $7.14 (vs. $5.88 expected)

- Daily Active Users: 3.48 billion (+6%)

- Free Cash Flow: $8.55 billion

- Cash and Marketable Securities: $47.07 billion

Meta’s operating costs also rose by 12% YoY, attributed to hiring in AI and Reality Labs, as well as server infrastructure growth.

Q3 2025 Outlook and Strategic Focus

Looking ahead, Meta projects Q3 2025 revenue in the range of $47.5 billion to $50.5 billion, reaffirming strong advertiser demand and continued platform engagement. Total expenses for 2025 are expected to land between $114 billion and $118 billion.

The company is doubling down on hiring AI researchers, particularly for its Superintelligence Lab, aimed at building what Zuckerberg describes as “personal superintelligence”—AI systems users can control to enhance their productivity and decision-making, rather than centralized models operated solely by corporations.

Investor Confidence and Market Impact

Meta’s stock surged over 12% in after-hours trading following the Q2 earnings release, reaching all-time highs near $780 per share. Analysts responded positively, with firms like Bernstein, Wedbush, and Evercore ISI raising their price targets. Some now project Meta’s valuation could exceed $930 per share by year-end, citing its dominant AI ad position and global user base.

Summary: Meta Q2 2025 Earnings Reinforce AI Leadership and Global Scale

Meta’s Q2 2025 earnings confirm its transformation into an AI-first company. With ad performance soaring, user engagement rising, and long-term innovation in full gear, Meta has reasserted its dominance in the digital advertising and tech ecosystem.