Nigeria’s fintech industry has grown into one of Africa’s most dynamic sectors, attracting global attention, billion-dollar valuations, and record-breaking transaction volumes. In 2025, leading players are pushing boundaries, transforming payment systems, deepening financial inclusion, and expanding across Africa and beyond.

This article highlights the biggest fintech companies in Nigeria this year, their milestones, and their impact on the economy.

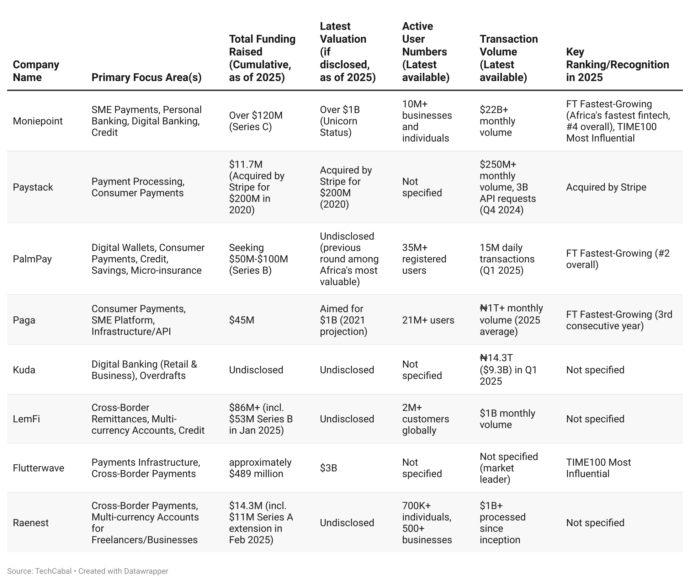

1. Moniepoint (formerly TeamApt)

Moniepoint cemented its place as a fintech powerhouse after achieving unicorn status in late 2024. The milestone followed a $120 million Series C funding round, with Visa contributing $10 million.

The platform serves over 10 million users and processes more than one billion transactions monthly, surpassing $100 billion in total payments last year.

In 2025, Moniepoint expanded aggressively into East Africa, acquiring a majority stake in Kenya’s Sumac Bank. It also launched MonieWorld, an international remittance service targeting African diaspora communities.

2. Paystack

Paystack, acquired by Stripe for $200 million in October 2020, remains a leading force in payment processing. The company handles over $250 million in monthly transactions and in Q4 2024 processed three billion API requests.

In March 2025, Paystack unveiled Zap, a lightning-fast consumer transfer service for Nigerian bank accounts, positioning itself as a competitor to traditional banking transfers.

3. PalmPay

PalmPay has rapidly grown into one of the continent’s largest digital payment platforms. Ranked second on the Financial Times list of Africa’s fastest-growing companies, PalmPay now serves over 35 million users.

In Q1 2025 alone, it processed more than 15 million daily transactions, totaling ₦71.5 trillion in 2024, with 80% of users active monthly—a retention rate far above industry averages.

4. Paga

Founded in 2009, Paga remains one of Nigeria’s most trusted payment platforms. Over its lifespan, it has processed more than ₦23 trillion, with ₦8.7 trillion handled in 2024 alone.

By 2025, monthly transaction volumes exceeded ₦1 trillion. Paga’s ecosystem includes:

- Paga (consumer services)

- Doroki (tools for SMEs)

- Paga Engine (infrastructure for third parties)

Its steady growth demonstrates how local fintechs can achieve profitability without compromising innovation.

5. Kuda

Kuda, Nigeria’s leading digital bank, has continued scaling rapidly. In Q1 2025, it processed over 300 million transactions worth ₦14.3 trillion.

The bank issued ₦16.4 billion in overdrafts profitably and aims to hit ₦57 trillion in transaction volume by year-end. It also re-launched its remittance service for diaspora customers, offering seamless cross-border transfers.

6. LemFi

LemFi specializes in cross-border payments and remittances, serving over two million customers in the U.S., UK, Canada, and Europe.

In January 2025, it raised $53 million in Series B funding, bringing total investment to over $86 million. LemFi processes $1 billion in monthly transactions and recently acquired UK credit card company Pillar to enhance its service offering.

7. Flutterwave

Flutterwave holds the title of Africa’s most valuable fintech, valued at around $3 billion. The company processed over 890 million transactions worth $34 billion in the past year.

Its infrastructure now spans 34 African countries, and in 2025, it secured a payment institution license from BCEAO, enabling operations in Senegal. Flutterwave’s expansion strategy continues to focus on regulatory compliance and pan-African reach.

8. Raenest

Raenest targets freelancers, remote workers, and digital entrepreneurs. It offers multicurrency wallets, virtual dollar cards, loyalty programs, and international transfers.

In February 2025, the company raised $11 million in a Series A extension, bringing its total funding to $14.3 million. To date, Raenest has processed over $1 billion in transactions, serving 700,000+ individuals and 500+ businesses.

The Rise of Nigerian Fintech in 2025

The companies above are not just dominating payment processing—they are expanding into lending, remittances, banking, and financial infrastructure. Collectively, they:

- Serve tens of millions of users worldwide.

- Process trillions of naira and billions of dollars annually.

- Expand into new African and global markets.

This evolution reflects Nigeria’s position as a fintech innovation hub, with startups attracting global investors, building scalable solutions, and increasing financial inclusion.

Conclusion

In 2025, Nigerian fintech companies are proving they can compete on a global stage. With bold expansions, strategic acquisitions, and cutting-edge technology, these firms are setting the standard for Africa’s digital economy.

Their next challenge will be sustaining growth while navigating evolving regulations, competitive pressures, and user trust demands. But given their track record, Nigeria’s fintech leaders seem more than ready for the task.